10 Simple Techniques For Property By Helander Llc

10 Simple Techniques For Property By Helander Llc

Blog Article

The Of Property By Helander Llc

Table of ContentsExcitement About Property By Helander LlcProperty By Helander Llc - TruthsIndicators on Property By Helander Llc You Need To Know8 Easy Facts About Property By Helander Llc ShownProperty By Helander Llc - The FactsThe 2-Minute Rule for Property By Helander Llc

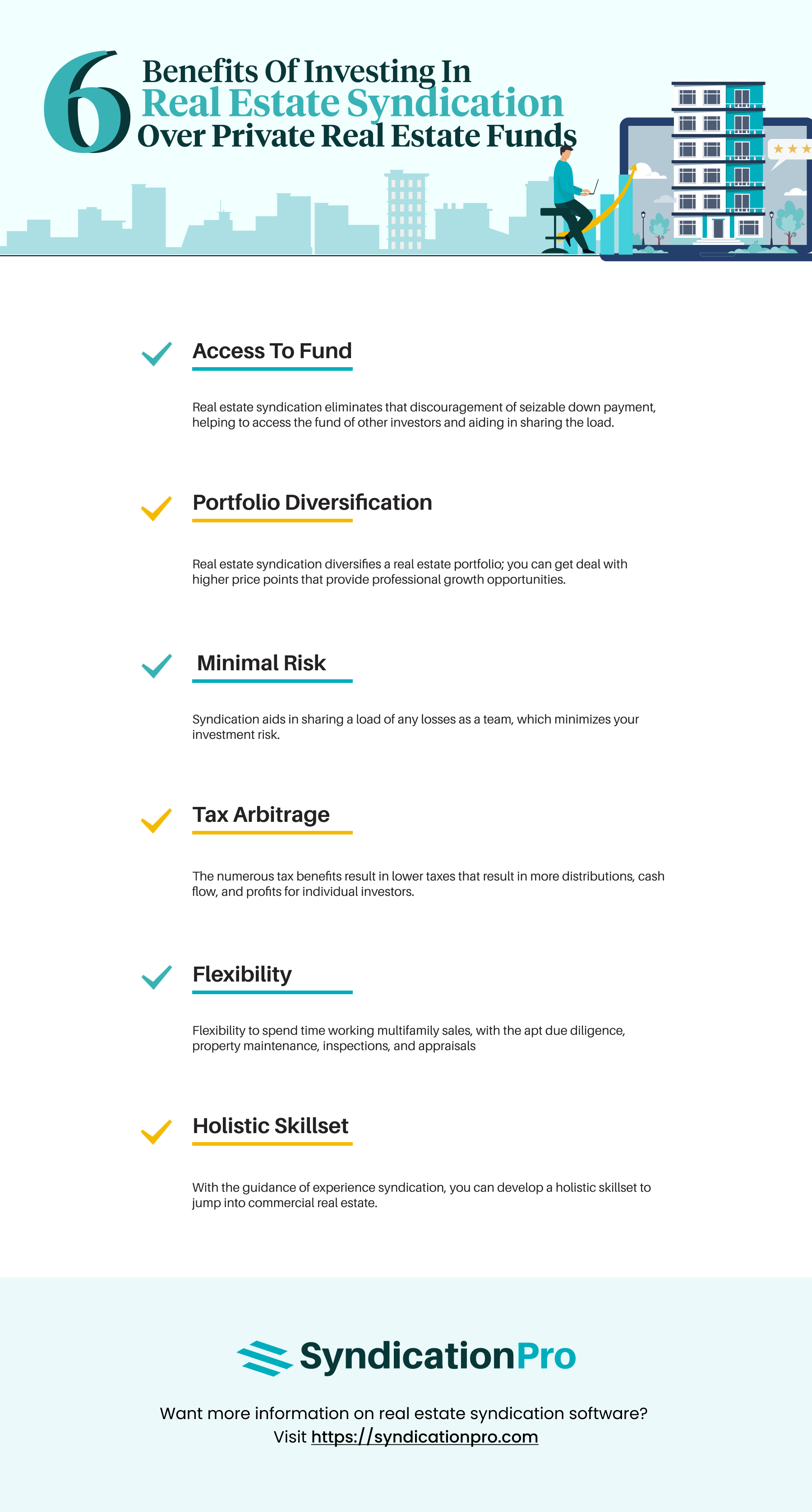

The benefits of investing in property are many. With well-chosen properties, capitalists can enjoy foreseeable capital, excellent returns, tax benefits, and diversificationand it's feasible to utilize property to construct wide range. Believing concerning purchasing property? Below's what you require to understand concerning realty advantages and why genuine estate is thought about a great investment.The advantages of investing in actual estate include easy income, steady money flow, tax advantages, diversification, and leverage. Genuine estate financial investment trust funds (REITs) offer a means to invest in real estate without having to own, operate, or financing buildings.

In several instances, capital just reinforces over time as you pay down your mortgageand accumulate your equity. Investor can take benefit of various tax breaks and reductions that can save money at tax time. In general, you can subtract the practical costs of owning, operating, and taking care of a property.

How Property By Helander Llc can Save You Time, Stress, and Money.

Genuine estate values have a tendency to enhance over time, and with a great investment, you can turn an earnings when it's time to sell. As you pay down a property mortgage, you construct equityan possession that's component of your internet well worth. And as you construct equity, you have the take advantage of to buy more homes and enhance cash money flow and riches also more.

Since property is a substantial property and one that can function as collateral, funding is easily offered. Property returns vary, depending on aspects such as location, asset class, and monitoring. Still, a number that numerous capitalists aim for is to defeat the ordinary returns of the S&P 500what lots of people refer to when they state, "the market." The inflation hedging ability of property originates from the positive relationship in between GDP development and the need for real estate.

Getting My Property By Helander Llc To Work

This, in turn, equates right into higher funding worths. Genuine estate often tends to preserve the acquiring power of funding by passing some of the inflationary stress on to renters and by integrating some of the inflationary stress in the form of resources gratitude - Sandpoint Idaho homes for sale.

Indirect actual estate spending entails no direct ownership of a residential property or homes. There are several ways that owning genuine estate can shield versus rising cost of living.

Properties funded with a fixed-rate loan will see the relative amount of the regular monthly mortgage payments drop over time-- for circumstances $1,000 a month as a fixed repayment will certainly become much less troublesome as rising cost of living deteriorates the purchasing power of that $1,000. https://www.easel.ly/browserEasel/14494468. Typically, a primary residence is not considered to be a realty financial investment given that it is used as one's home

The Best Strategy To Use For Property By Helander Llc

Despite the help of a broker, it can take a couple of weeks of work just to find the ideal counterparty. Still, realty is a distinct asset class that's easy to recognize and can boost the risk-and-return profile of a capitalist's portfolio. By itself, realty provides cash flow, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a bush against inflation.

Buying property can be an exceptionally satisfying and profitable venture, but if you resemble a great deal of new financiers, you may be wondering WHY you must be investing in property and what advantages it brings over various other financial investment chances. In enhancement to all the fantastic advantages that come along with buying property, there are some downsides you visit site require to consider also.

Not known Factual Statements About Property By Helander Llc

If you're seeking a way to buy into the realty market without having to invest numerous hundreds of dollars, have a look at our residential or commercial properties. At BuyProperly, we use a fractional ownership model that permits financiers to start with as low as $2500. One more significant benefit of realty investing is the capacity to make a high return from acquiring, refurbishing, and re-selling (a.k.a.

8 Simple Techniques For Property By Helander Llc

If you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible expenditures per month, you will only be paying tax obligation on that $500 revenue per month (realtors in sandpoint idaho). That's a large distinction from paying taxes on $2,000 per month. The profit that you make on your rental unit for the year is taken into consideration rental revenue and will certainly be taxed as necessary

Report this page